|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Loan with Poor Credit: A Comprehensive GuideRefinancing a home loan can be a strategic financial decision, even if you have poor credit. Understanding how to navigate this process effectively is crucial to improving your financial situation and securing better loan terms. Understanding Refinancing with Poor CreditRefinancing involves replacing your existing mortgage with a new one, often with a lower interest rate or better terms. For those with poor credit, this might seem challenging, but it's not impossible. Assessing Your Current Financial SituationBefore applying for refinancing, evaluate your current financial standing. This includes checking your credit score, understanding your debt-to-income ratio, and reviewing your existing mortgage terms.

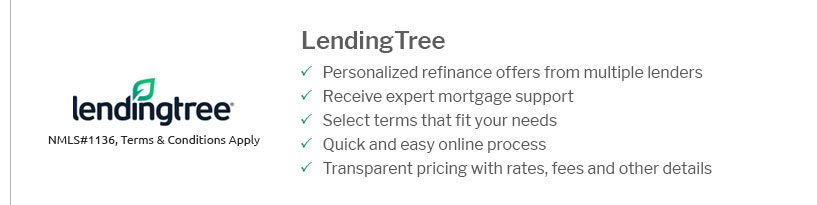

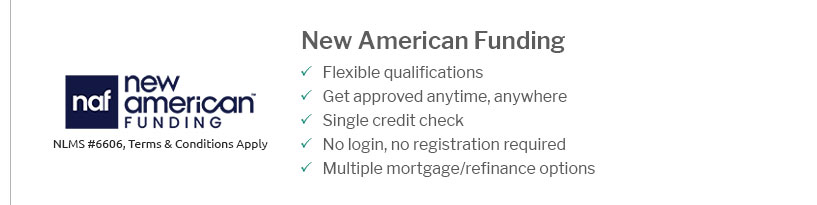

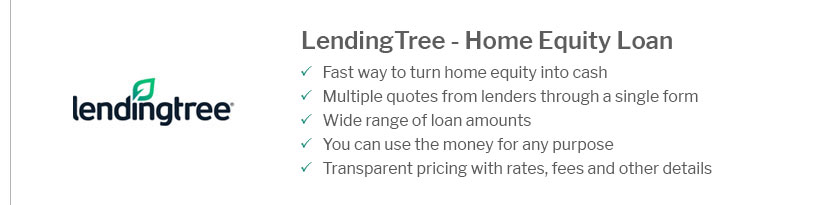

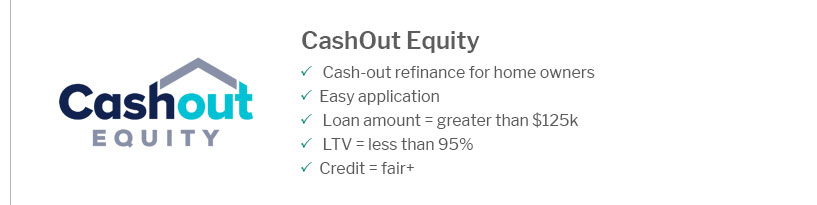

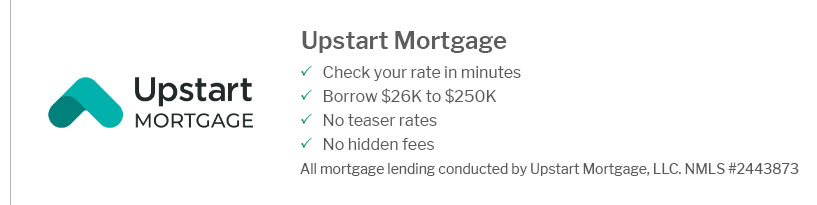

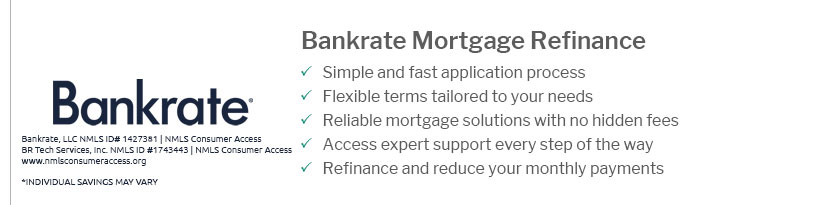

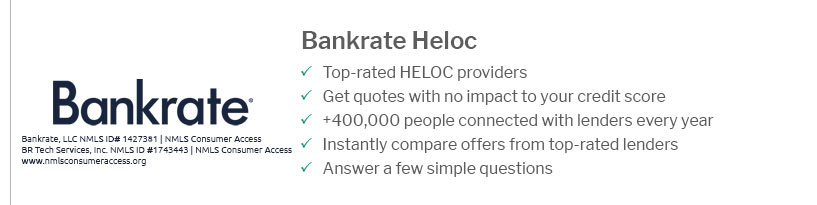

Steps to Refinance with Poor CreditExplore Different LendersNot all lenders have the same requirements. It's important to shop around and find a lender who is willing to work with individuals who have poor credit. Consider visiting best place to refinance my house for lender comparisons and options. Consider Government-Backed LoansGovernment programs like FHA, VA, or USDA loans might offer more lenient credit requirements, making them a viable option for refinancing. Improve Your Credit ScoreTaking steps to improve your credit score can increase your chances of qualifying for a better rate. This includes paying down existing debts, ensuring timely payments, and avoiding new credit inquiries. Pros and Cons of Refinancing with Poor CreditUnderstanding the benefits and drawbacks can help you make an informed decision. Advantages

Disadvantages

How to Make Refinancing Work for YouStrategize to make the most out of refinancing. Utilize online resources to compare rates and terms. A good starting point is checking 30 yr fixed refi rates to find competitive offers. Frequently Asked Questions

https://money.usnews.com/loans/mortgages/articles/can-you-refinance-with-bad-credit

Mortgage lenders typically look for a credit score of at least 620 to refinance conventional loans, but standards can be more flexible with government-backed ... https://www.lowermybills.com/learn/owning-a-home/how-to-refinance-with-bad-credit/

There are options to qualify for refinancing with bad credit, but having poor credit typically means your loan will have a higher interest rate. https://www.quora.com/Will-any-lenders-refinance-existing-home-loans-for-people-who-have-bad-credit

The only reason to refinance is to lower your payment: bad credit may result in a higher interest rate than if you have good credit. Before you ...

|

|---|